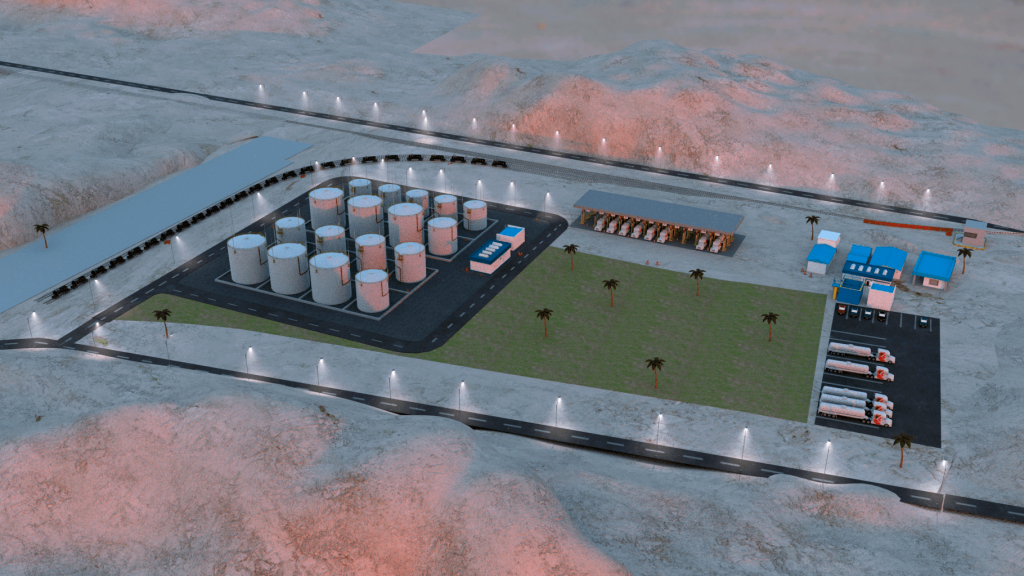

Lexington Midstream is a Mexican energy company focused on the development and acquisition of Midstream Assets such as: Storage and Transportation Terminals (barge, railroad, truck and pipeline). The team is made up of a group of experts in finance and investment in the energy sector, import and commercialization of hydrocarbons.

Our company has developed strong strategic alliances with commercial companies in the United States to achieve the most competitive prices and with the main consulting firms in Mexico to help in the development process, from feasibility studies to permits, EPC, technology and operation of the terminals.

After more than seven decades under a hydrocarbon industry model closed to private investment in almost the entire value chain, Mexico began to implement profound changes since the Energy Reform was presented on December 20, 2013. The main objective is promote competition within the sector, develop the necessary infrastructure to allow the complete supply of hydrocarbons, advance the sustainability of the industry, as well as take advantage of energy resources and maximize profits. In this sense, the regulation of the CRE for fuel storage has focused on laying the foundations to encourage private participation, since before the presentation of the Energy Reform, PEMEX (Compañía Nacional de Petróleo de México) was the only participant in fuel storage activities.

Currently Mexico has 2-5 days of storage, which represents a great opportunity for the development of infrastructure in the country.

Lexington Midstream follows principles of environmental and social responsibility (Environmental, Social & Governance “ESG”) when making investments and monitoring companies as well as the implementation of Principles of Responsible Investment (PRI) and Sustainable Development Goals (UN SDG) 2030. These investment criteria help us reduce risks and improve financial performance; seeking to add value, have a positive impact on the planet and exceed the expectations of our stakeholders.

Main objectives of the UN Sustainable Development Agenda.

We are primarily focused on the development and acquisition of Hydrocarbon Storage Terminals within Mexico.